Introduction

Aaj ke samay me har koi apne paise ko grow karna chahta hai. Inflation ke time me simple savings account ya fixed deposit se paisa double karna mushkil hai. Isi wajah se log share market aur mutual funds me invest karna pasand karte hain. Lekin aksar sawal uthta hai – “Share market better hai ya mutual funds?” Chaliye detail me samajhte hain.

Share Market Kya Hai?

Share market ek aisi jagah hai jahan companies apne shares issue karti hain aur investors inhe kharidte hain. Jab aap kisi company ka share kharidte ho, to aap us company ke partial owner ban jaate ho.

- Return: Agar company grow karti hai to aapke shares ki value badh jaati hai.

- Risk: Market me uthal puthal ke wajah se share prices kabhi bhi gir ya badh sakte hain.

- Control: Aap khud decide karte ho ki kaunsi company me invest karna hai.

Example: Reliance, TCS, Infosys jaisi companies ke shares direct buy karna.

Mutual Funds Kya Hain?

Mutual funds ek pooled investment option hote hain jisme bahut saare investors ka paisa ek fund me collect hota hai. Is fund ko ek professional fund manager manage karta hai aur alag-alag shares, bonds ya securities me invest karta hai.

- Return: Thoda stable hota hai kyunki investment diversified hota hai.

- Risk: Kam hota hai kyunki paisa ek hi share me nahi, balki multiple assets me lagta hai.

- Expert Management: Professionals aapke liye research karke invest karte hain.

Example: SBI Mutual Fund, HDFC Mutual Fund, ICICI Prudential Mutual Fund.

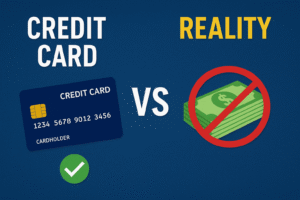

| Factor | Share Market | Mutual Funds |

|---|---|---|

| Risk | High – Market volatile hota hai | Moderate – Diversification se risk kam hota hai |

| Return | Zyada profit ho sakta hai | Stable aur consistent return milta hai |

| Knowledge | Market ki samajh aur analysis ki zarurat | Beginners ke liye easy, expert manage karte hain |

| Control | Puri freedom hai kis company me invest karna hai | Fund manager decide karta hai kaha invest hoga |

| Liquidity | Shares kabhi bhi bech sakte ho | Redemption possible but thoda time lag sakta hai |

| Charges | Brokerage fees lagti hai | Fund management charges lagte hain |

Kaun Kisko Choose Kare?

👉 Share Market Kiske Liye Best Hai?

- Jo log market ka knowledge rakhte hain

- Jo high risk le sakte hain

- Jinko short-term aur long-term dono me invest karna hai

👉 Mutual Funds Kiske Liye Best Hai?

- Beginners jo abhi share market samajhna shuru kar rahe hain

- Jo safe aur stable return chahte hain

- Jinke paas market analysis ka time nahi hai

Conclusion

Share market aur mutual funds dono hi achhe investment options hain, lekin dono ka nature alag hai. Agar aapko direct market ka thrill, high risk aur high return chahiye to share market best hai. Lekin agar aap safe aur managed investment chahte ho jisme experts aapke liye decision lein, to mutual funds better option hain.

Smart investor wahi hai jo apne financial goals, risk appetite aur knowledge ke hisaab se dono ka mix portfolio banata hai.