आजकल हर kisi का सपना होता है ki वो financial independence achieve करे – यानी aisi स्थिति जब aapko apne खर्चों ke लिए actively काम करने की ज़रूरत ना पड़े और aapke पास itna पैसा हो ki आप आराम से अपनी lifestyle को maintain कर सकें. अब सवाल उठता है: क्या ₹10 Crore (100 Million INR) India में financial independence के लिए enough है? आइए इसको detail में समझते हैं.

Financial Independence ka Matlab Kya Hai?

Financial independence का मतलब simple words में ये है ki aapke पास इतना बड़ा wealth corpus हो jo aapki yearly expenses को बिना tension के cover कर सके, aur ideally inflation ke साथ adjust bhi हो सके. इसका मतलब ये भी hai ki aapko रोज़गार, नौकरी ya business par depend nahi करना पड़े, बल्कि आपके investments ही आपकी जिंदगी चलाएं.

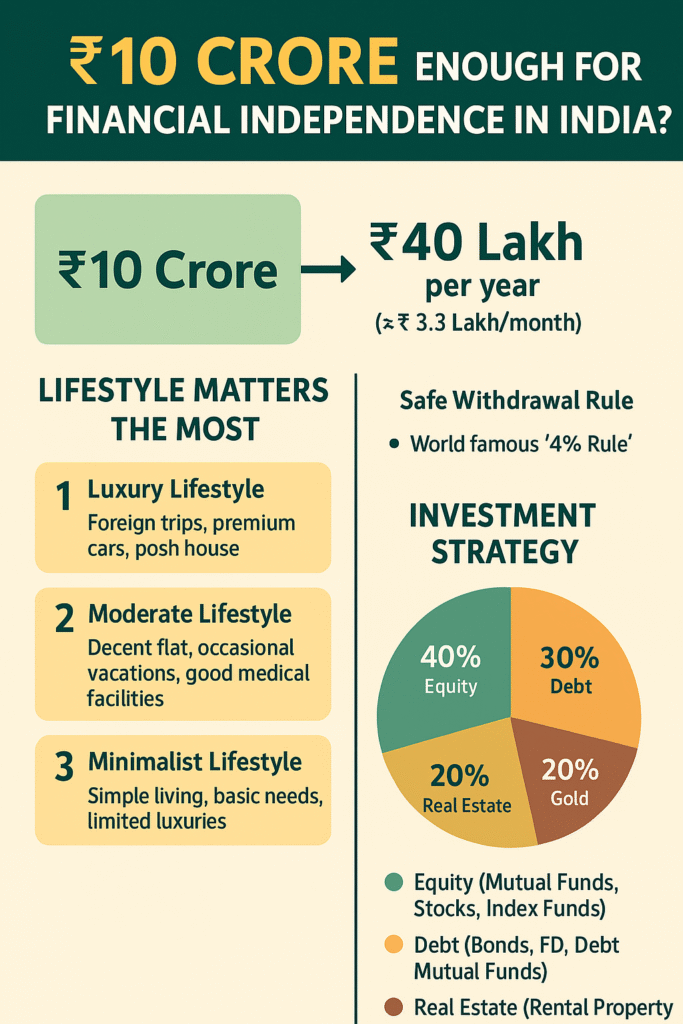

Lifestyle Matters the Most

सबसे पहली और सबसे important बात ये है ki financial independence purely lifestyle dependent hai.

- अगर aap luxury lifestyle chahte hain – foreign trips, premium cars, posh house – तो ₹10 crore शायद enough ना हो.

- अगर aap moderate lifestyle follow karte hain – अच्छी family car, decent flat, occasional vacations, और अच्छे medical facilities – तो ₹10 crore kaafi हो सकता है.

- Agar aap minimalist lifestyle follow karte ho – simple living, basic needs, limited luxuries – तो ₹10 crore easily more than enough hoga.

Corpus Calculation – ₹10 Crore ka Income Potential

अब देखते हैं ki agar aapke पास ₹10 crore का lump sum corpus hai to aapko annually कितना income generate होगा.

- Safe Withdrawal Rule (SWR) – World famous “4% Rule” ke अनुसार, aap apne corpus ka 4% har साल nikal सकते हैं without exhausting it for at least 25-30 years.

- ₹10 Crore × 4% = ₹40 Lakh per year (approx ₹3.3 Lakh per month).

- Conservative Indian Scenario – India me inflation thoda high hai (6-7% tak). Isliye 4% rule thoda risky ho sakta hai.

- Safe withdrawal better rahega 3.5%–3.8% range me.

- Agar aap 3.5% nikalते हैं to yearly ₹35 Lakh aur monthly ₹2.9 Lakh mileगा.

Major Expenses to Consider in India

Financial independence ke calculation में सिर्फ daily खर्च consider karna galat hoga. आपको long-term aur unpredictable खर्चों को भी देखना होगा:

- Healthcare – India में health emergencies काफी महंगी हो सकती हैं. A good health insurance policy रखना ज़रूरी hai.

- Children’s Education – Private colleges aur foreign education ke खर्च easily ₹50 Lakh – ₹1 Crore तक हो सकते हैं.

- Inflation – 6-7% inflation का मतलब hai ki आज का ₹1 lakh खर्च 15 साल बाद ₹2-3 lakh हो जाएगा.

- Lifestyle Inflation – जैसे-जैसे income बढ़ती है, वैसे-वैसे खर्च भी बढ़ता hai. Aapko discipline रखना होगा.

Investment Strategy for ₹10 Crore Corpus

Financial independence tabhi sustainable hogi jab aap apne ₹10 crore को wisely invest करें. सिर्फ bank FD या savings account में रखने से काम नहीं चलेगा.

Suggested Portfolio (Example):

- 40% Equity (Mutual Funds, Stocks, Index Funds): Long-term growth aur inflation beat karne के लिए.

- 30% Debt (Bonds, FD, Debt Mutual Funds): Stable aur predictable returns के लिए.

- 20% Real Estate (Rental Property): Passive income aur asset diversification के लिए.

- 10% Gold/Digital Gold/REITs: Hedge against inflation aur uncertainty ke लिए.

Is portfolio से aapko average 8-10% annual return मिल सकता hai, jo sustainable hai

Who Can Achieve FI with ₹10 Crore?

- Metro Cities (Delhi, Mumbai, Bangalore): यहाँ living cost high है. ₹10 crore से आराम से middle to upper-middle-class lifestyle possible hai, लेकिन ultra-luxury नहीं.

- Tier-2/Tier-3 Cities: यहाँ cost of living low hai. ₹10 crore से आप luxury lifestyle bhi comfortably enjoy कर सकते हैं.

- Retired Couple: Agar aapke बच्चों की पढ़ाई और शादी already हो चुकी है, तो ₹10 crore is more than enough.

- Young Families: Agar बच्चों की पढ़ाई, शादी aur long-term medical खर्च pending hai, तो आपको थोड़ा extra buffer चाहिए होगा.

Pros and Cons of ₹10 Crore FI Plan

Pros:

- Secure aur stable lifestyle.

- Passive income of ₹35-40 Lakh per year possible.

- Emergency situations ke लिए buffer.

- Freedom to choose – काम करना है ya नहीं.

Cons:

- Agar lavish lifestyle chahte hain, तो ₹10 crore कम पड़ सकता hai.

- Inflation aur healthcare costs unpredictable hain.

- Poor investment decisions se corpus khatam bhi ho सकता hai.

Final Verdict

तो क्या ₹10 Crore India में financial independence के लिए enough hai?

👉 Yes – for most middle-class aur upper-middle-class families, especially tier-2 cities में.

👉 Maybe – metro cities में अगर aap luxury lifestyle चाहते हैं तो.

👉 No – अगर aap billionaire-style ultra-luxury lifestyle चाहते हैं.

₹10 Crore ek strong corpus hai jo आपको financial independence दिला सकता hai, लेकिन सही investment strategy, disciplined spending aur inflation ko ध्यान में रखना ज़रूरी hai.